35+ how to get out of reverse mortgage

Web Beranda 35 A Images reverse. Web Our reverse mortgage calculator can help you determine how much money you might qualify to receive in a lump-sum payment.

Reverse Mortgage Nightmare Why Seniors Are Losing Their Homes Abi

Web By refinancing your home loan you can get out of a joint mortgage or remove another partys name from the loan.

. Ad Eliminate Monthly Mortgage. You are fully responsible for. Web To get your name off a mortgage youll have to either sell the property if youre the sole borrower or have a co-borrower refinance if you jointly own property.

Find Out In Less Than 2 Minutes If A Reverse Mortgage Is Right For You. For Homeowners Age 61. A home equity conversion mortgage HECM is a reverse mortgage thats backed by the federal government.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. There are no monthly principal and interest. Sell the property buy it or allow the lender to foreclose.

Web Posted 65614 PM. Are you looking to work from home and join a dynamic team. Reverse MortgageSee this and similar jobs on LinkedIn.

Web In that case theres only one way to get out of a reverse mortgage. Weve simplified the process with MoneyGeeks Reverse Mortgage. Lenders then have 20 days to return any money you had paid for financing or origination fees.

How To Get Out Of A Reverse Mortgage Rocket Mortgage Mid. Web The Right of Rescission. The great news is the answer is yes.

Ad Compare the Best Reverse Mortgage Lenders. A younger retiree can stay in the house while turning equity into an income stream Craig Lemoine the. For example according to an AARP estimate when.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. After all it is a loan and just like any other loan the only way to be released from it.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. The most common way to repay a reverse mortgage is to sell the home and use the proceeds to pay back the loan.

The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Get A Free Information Kit.

Web Reverse mortgages often come with high fees and closing costs and a potentially costly mortgage insurance premium. Check Your Eligibility For A Reverse Mortgage. Ad Compare the Best Reverse Mortgage Lenders.

Tap Your Home Equity Without the Burden of Additional Debt. Ad The Reverse Mortgage Alternative. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

Get A Free Information Kit. See if you qualify. Web A reverse mortgage enables you to withdraw a portion of your homes equity to supplement your income or to purchase a home.

Web Passes away 1. As the name suggests reverse mortgages work like. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

By paying it off. Were seeking a Sr. 35 can you reverse a reverse mortgage Minggu 19 Februari 2023 Edit.

Web Youll usually have three options. For Homeowners Age 61. For loans equal to 60 or less of the.

Web A reverse mortgage may be worth considering earlier on in retirement. No personal information is required to calculate. For Homeowners Age 61.

Web The amount you can borrow will depend on your age the value of the home and current interest rates. If you have passed the point of no return then you might want to talk with a financial advisor about whether it makes sense to sell the house. For Homeowners Age 61.

These reverse mortgage products. Web Thats a lot to consider and the relationship between these multiple factors is complicated. Ad Dedicated to helping retirees maintain their financial well-being.

Use a quitclaim deed A quitclaim deed is a. Most reverse mortgage loans come with a period called the right of rescission similar to a cooling-off period. There are many tools you can use to plan your estate to make things easier for those you leave behind.

Web Youll have to notify your reverse mortgage lender in writing. Web A reverse mortgage can be an expensive way to borrow. While repayment of the loan is due within 30 days of the time the estate.

Mortgage Navigators Sydney Home Loan And Mortgage Broker Specialists

531 Reverse Mortgage Stock Photos Free Royalty Free Stock Photos From Dreamstime

Inlanta Mortgage Guild Mortgage The Kupka Team Conventional Loans Usda Loans Va Loans Fha Loans

How To Get Out Of A Reverse Mortgage Pointers

How To Pay Off A Reverse Mortgage Early Step By Step Guide

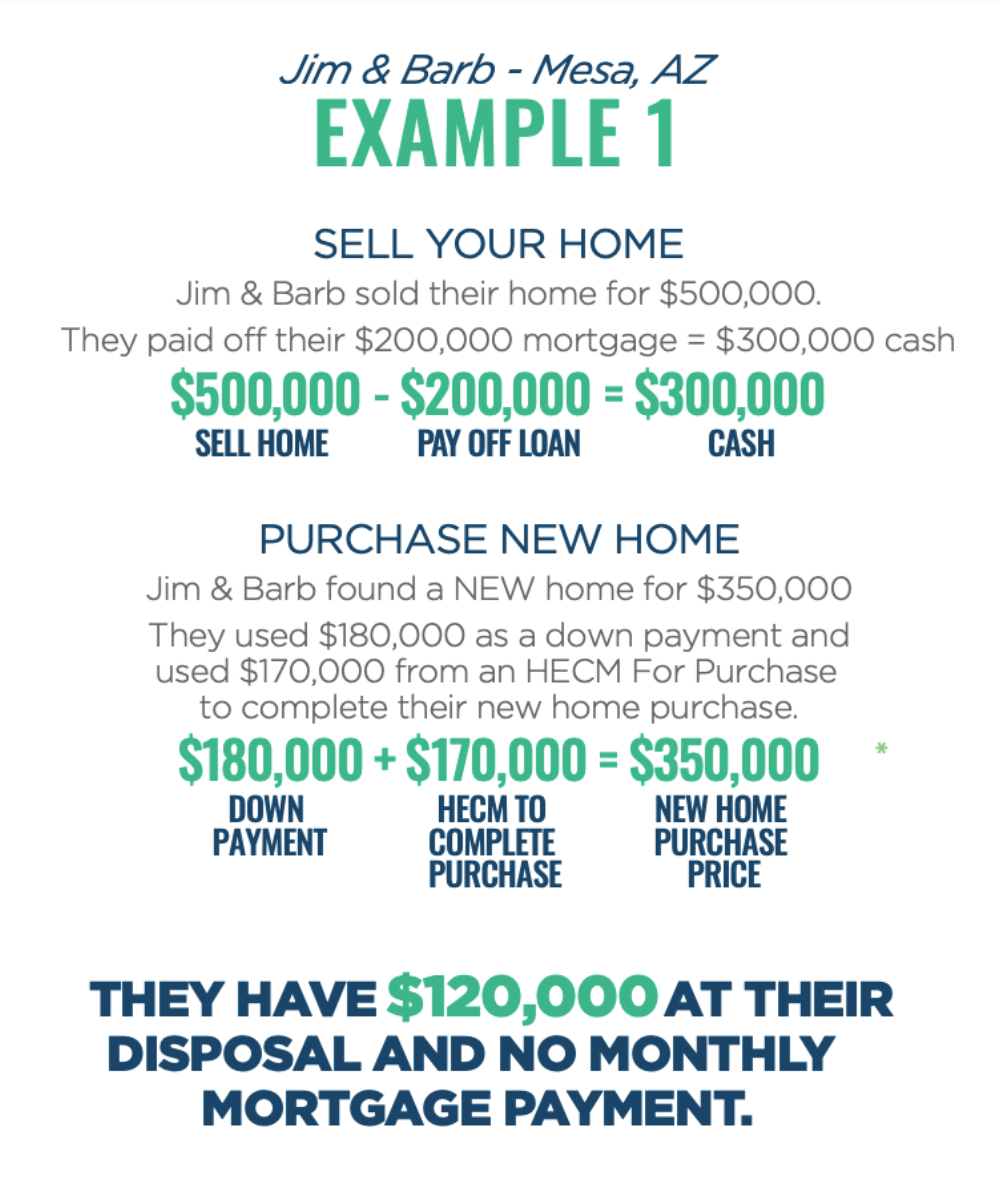

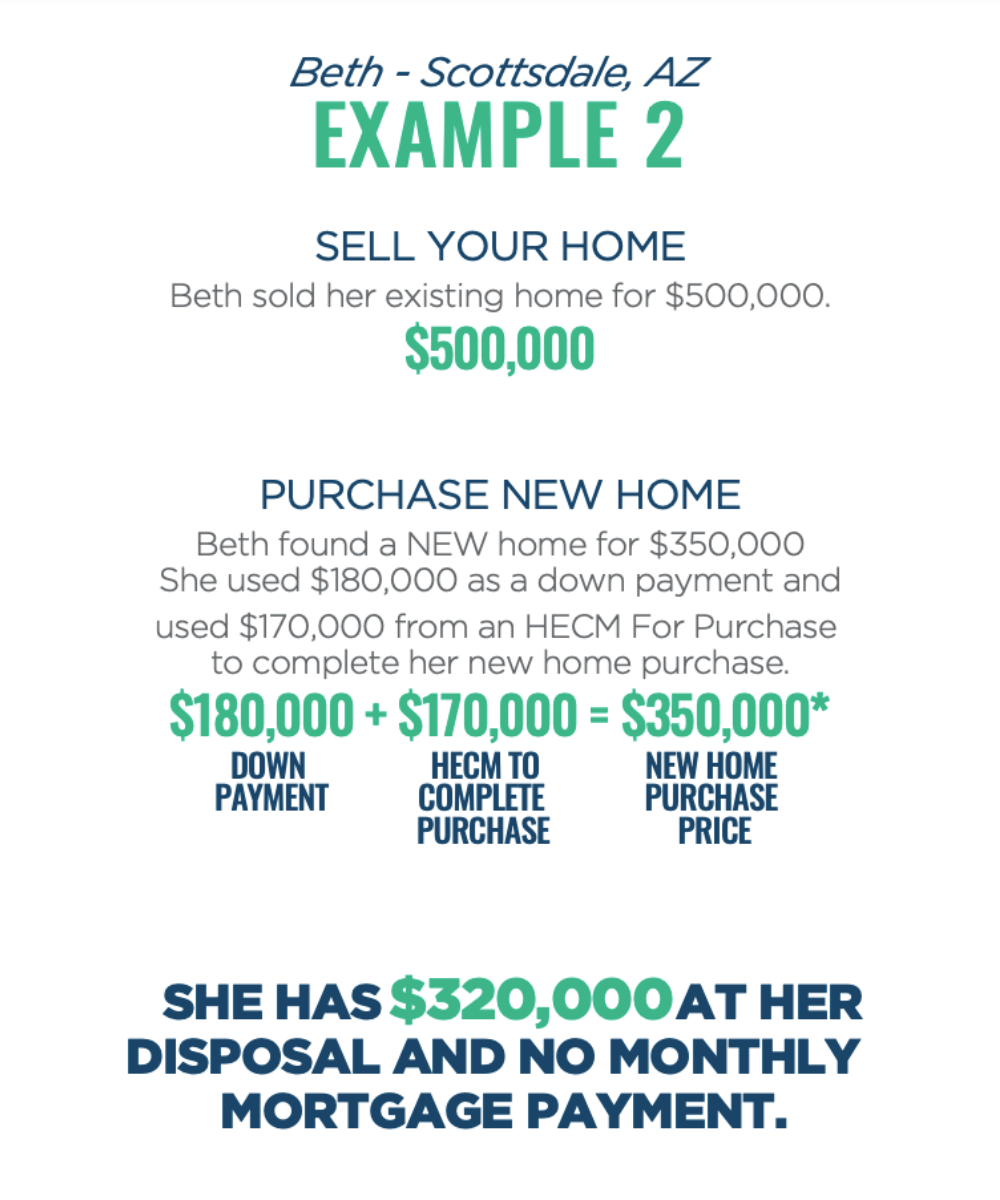

Reverse Mortgage Az Home Loan Sun American Mortgage Arizona Utah California

:max_bytes(150000):strip_icc()/GettyImages-1355067028-81cd0e06d4cd4b96a20d9a653fbe1063.jpg)

How To Get Out Of A Reverse Mortgage

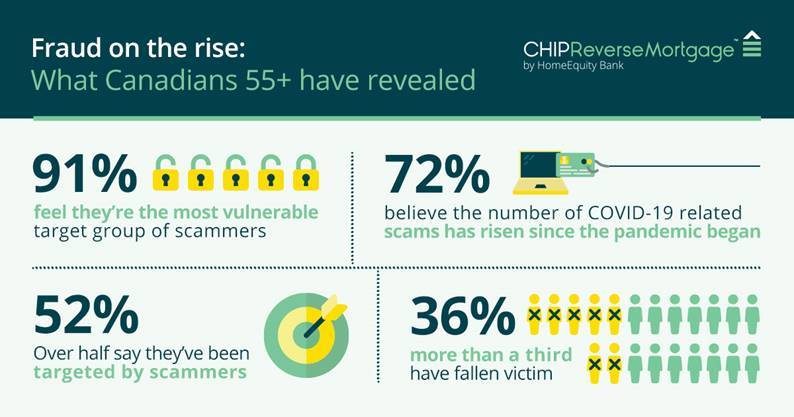

Reverse Mortgage Fraud Ratespy Com

How Long Does A Reverse Mortgage Take To Close

:max_bytes(150000):strip_icc()/senior-man-cooking--drinking-wine-and-looking-at-cookbook-in-kitchen-1089101214-d4a4c3d28c45484bbff31328932c9728.jpg)

How To Get Out Of A Reverse Mortgage

Mortgages For Senior Citizens

How Much Can I Get Out Of A Reverse Mortgage Youtube

Reverse Mortgage Az Home Loan Sun American Mortgage Arizona Utah California

How To Get Out Of A Reverse Mortgage What You Can Do Tally

Chip Reverse Mortgage Canada S Leading Reverse Mortgage Plan Homeequity Bank

How Much Can You Borrow With A Reverse Mortgage Ratespy Com

Member Spotlight